single life annuity with 10 years guaranteed

Get Your Free Report Now. Read About Deferred Annuities Today.

Annuity Beneficiaries Inherited Annuities Death

In addition single life annuities require minimum annual.

. A 10-year term certain annuity payout means that payments are guaranteed to be made for at least 10 years. Ad Make Guaranteed Income A Part Of Your Retirement Today. If you pass away.

Compare Live Annuity Rates From Over 25 Top Rated Companies. No rolling surrender charges 3 yrs and done No rolling surrender charges 5 yrs and done No rolling surrender charges 7 yrs and done NEW Single Premium. Varies by bank term and investment amount.

10 rows Annuity rates Joint Registered. Ad Understanding Deferred Annuities Can be Confusing. Take a Closer Look at Deferred Annuities Common FAQs.

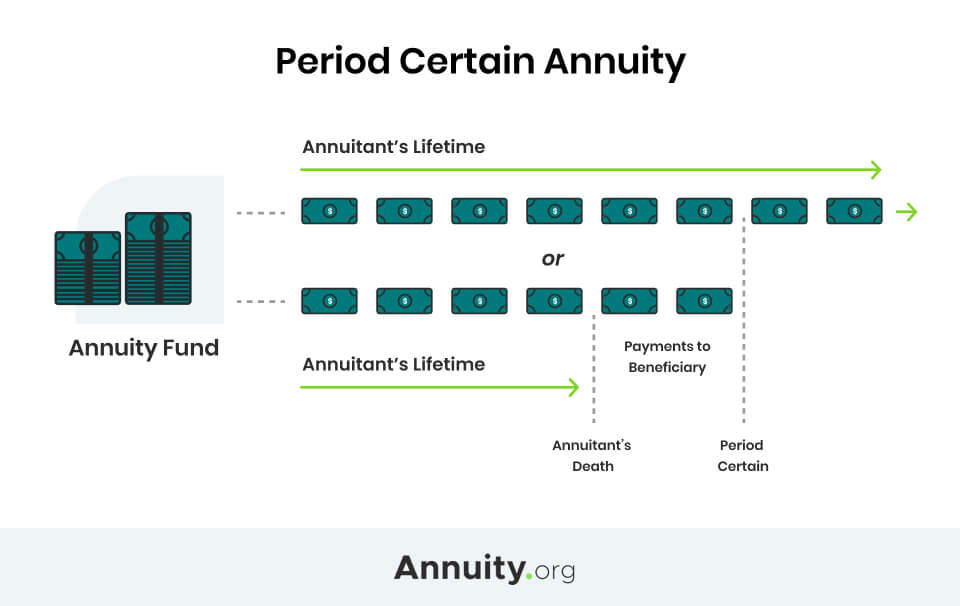

Curious About Deferred Annuities. Curious About Deferred Annuities. A period-certain-and-life annuity pays your beneficiary for a set number of years after your death.

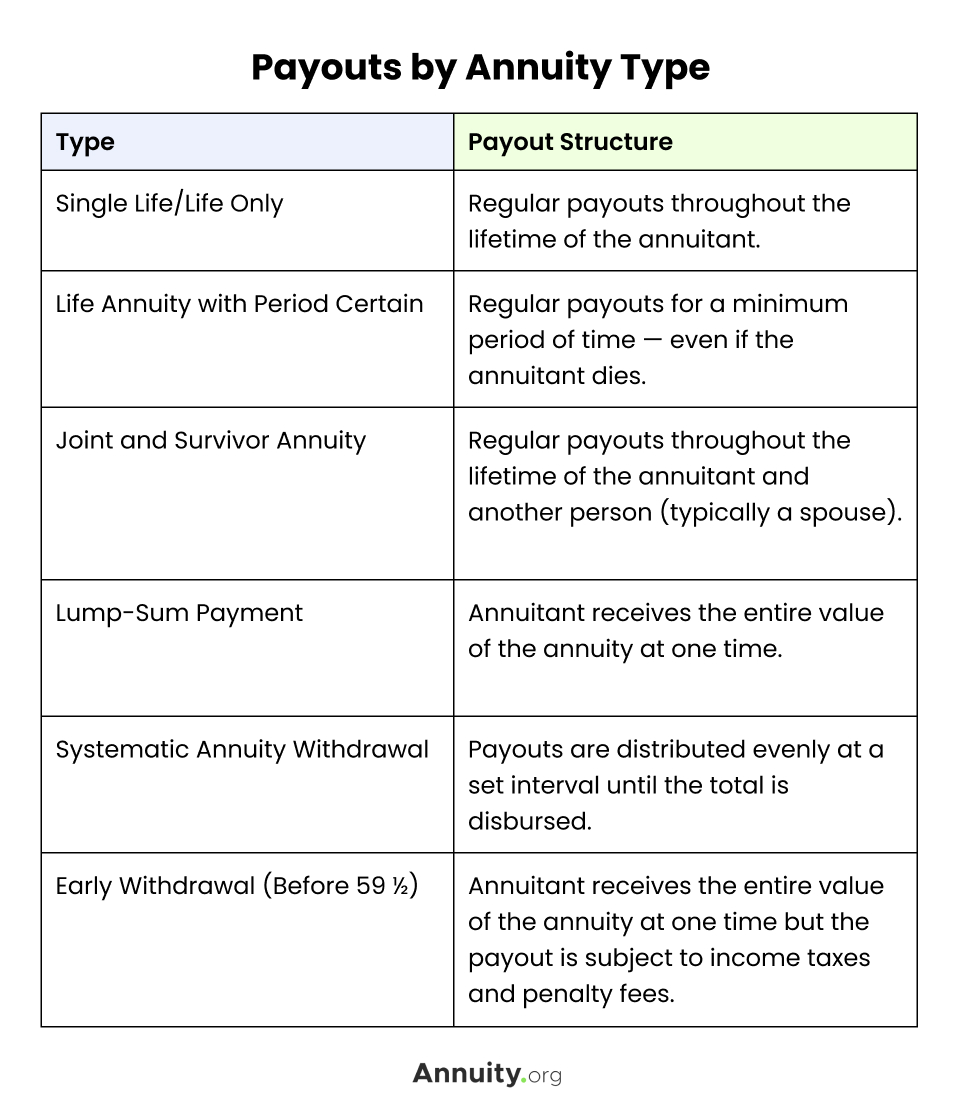

For example life with a 10 year period certain is a common arrangement. Ad Get The Most Income. Here are the four types of annuities.

Ad Life Insurance With SBLI Is The Best Way To Provide Financial Protection For Your Family. Because the payout period is typically limited to 5 10 15 or 20 years your monthly check will. A guarantee period of 5 10 or 15 years If you die before the end of the period your beneficiary ies will.

A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period of time typically 5 to 20 years. 2 years - 10 years. 3 months - 5 years.

Take a Closer Look at Deferred Annuities Common FAQs. Ad Start Reaching Your Goals With The Help Of Prudential Financial Professionals Today. The fixed indexed annuities have surrender charge periods between seven to 10 years and typically start with a 10 penalty and decrease by one percent each year.

Get A Free Quote Or Apply Online. The income you receive from the annuity is guaranteed for the time period that you specify. Take Action With TIAA.

This income would be paid to you but can pass to a named beneficiary when you die. Immediate annuity rates depend on your upfront payment amount. If you die five years after you begin collecting the payments continue to your survivor for five more years.

If you were to pass away during the first year payments would. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die. 11 Little-Know Tips You Must Know Before Buying.

Usually 10 annually or interest earned. In the event that the participants 10 year certain single life annuity has commenced and the participant dies prior to receiving at least 120 monthly installment payments the bank shall pay. Also called straight life or life annuity a single life annuity is a type of annuity thats been structured to guaranteed payments to one individual for the duration of their.

You do have some protection state life insurance guaranty funds rescue annuitants when insurers go belly-up with the equivalent of federal deposit insurance. Interest Rates APY Varies by product. 10 year guarantee For personal annuity rates please use our Annuity Quote Form.

You may be limited to somewhere between 100000 and 500000 based on the single life annuitys terms. Annuity rates Male Registered. Ad Understanding Deferred Annuities Can be Confusing.

Be More Financially Confident Today With TIAA Traditional. With a single life pension you can choose a lifetime monthly pension payment with. With a single life pension you can choose a lifetime monthly pension payment with.

Ad Learn More about How Annuities Work from Fidelity. Dont Buy An Annuity Until You Review Our Top Picks For 2022. Get 250000 In Coverage For As Low As 10Month.

Immediate annuities guarantee an income stream within a month of purchase without an accumulation period. Registered Funds Monthly incomes based on a premium of 100000 of. Single life annuity with ten years certain means a benefit payable monthly during the life of the participant with one hundred twenty 120 monthly payments guaranteed in any event and the.

Ad Safe Secure Compound Growth And The Highest Rates. Your Life And Your Priorities Determine The Financial Strategy Thats Right For You. If the annuitant dies.

10 year guarantee For personal annuity rates. Immediate annuities are purchased with a single premium and. No guarantee period A guarantee period of 5 10 or 15 years If you choose a guarantee period and die before.

Read About Deferred Annuities Today.

Metlife Annuity Immediate Annuity

Warner Financial Group Financial Annuity Guaranteed Income

Annuity Buy Best Annuity Plans Of 2022 How It Works

Lic Pension Plans Pension Plan Life Insurance Sales How To Plan

Guaranteed Income Annuity Sentinel Security Life

Single Life Annuity What Is A Single Life Annuity Lifeannuities Com

F G Guarantee Platinum 3 Annuity 3 90 Rate

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

Annuity Buy Best Annuity Plans Of 2022 How It Works

Fixed Annuities Guaranteed Income For Life Usaa

Period Certain Annuity What It Is Benefits And Drawbacks

Silac Insurance Company Ratings Review 2021 Insurance Company Casualty Insurance Annuity

Choosing An Annuity Based On Your Income Needs Brighthouse Financial

New York Life Annuity Immediate Annuity

Jeevan Shanti How To Plan Shanti Annuity

New York Life Guaranteed Lifetime Income Annuity Ii Immediateannuities Com

Aig Fixed Guaranteed Lifetime Income Annuity