hawaii tax id number cost

But on Oahu Kauai and the Big Island there is a 05 surcharge. There is no cost for an EIN when you apply directly through the Internal Revenue Service.

Online - DOTAX 5 days Online - HBE 2 weeks By mail or drop-off 4 weeks To apply in person bring two copies of your completed application.

. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common. Third party authorization TPA infoTPA is required in this state.

Effective January 02 2013 anyone applying for any original. For others it is desirable. GE-999-999-9999-01 All sales tax related.

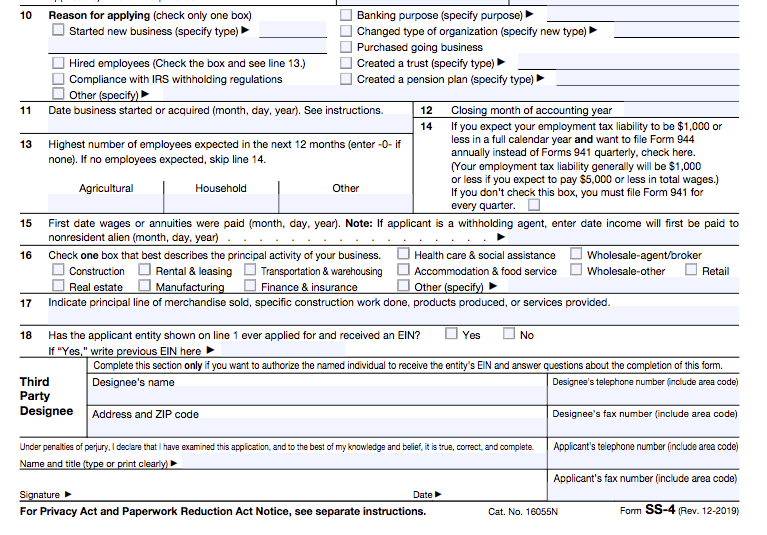

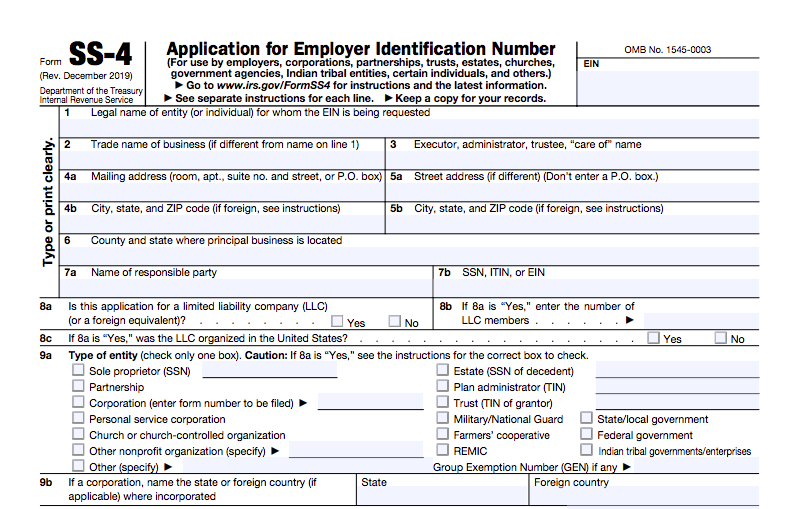

For many businesses it is a requirement. Should I get an EIN or LLC first. It is a nine-digit number than can be used in lieu of your Social Security number.

HONOLULU AIEA 96701 on. Finding your tax account number s and rates and entering them in Gusto. How much does it cost to get an EIN in Hawaii.

You can start your business and get a tax ID in AIEA cost to start is about 10817 or could start with 106677 that depends on your budget. DOE TAX CREDIT NUMBER. Ige approved this measure on June 22 2022 and it became Act 115 Session Laws of Hawaii 2022.

You also need to obtain any additional and. You can get a tax ID in. EIN stands for employee identification number.

Obtain your Tax ID in Hawaii by selecting the appropriate entity or business type from the list below. The statewide normal tax rate is 4. Once your application has been submitted our agents will begin on your behalf to file.

For all business entities wishing to issue tax licenses in Hawaii they must have a Hawaii Tax Identification Number HI. How Do I Get A Tax Id Number For My Business In Hawaii. When you file your tax.

11 rows Businesses operating in Hawaii are required to register with the Department to obtain a license permit certificate registration or exemption all generally referred to by. This number also allows a retailer to enroll or obtain a Resale Certificate Sales Tax Permit or Sellers Permit all refer to the same thing which allows for tax-exempt status. How much is Hawaii GE Tax.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4. If you file Form BB-1You will receive your HI Tax ID. Determine if you need an EIN for your Hawaii business Perhaps the best way to think about an EIN is like a social security number for your business.

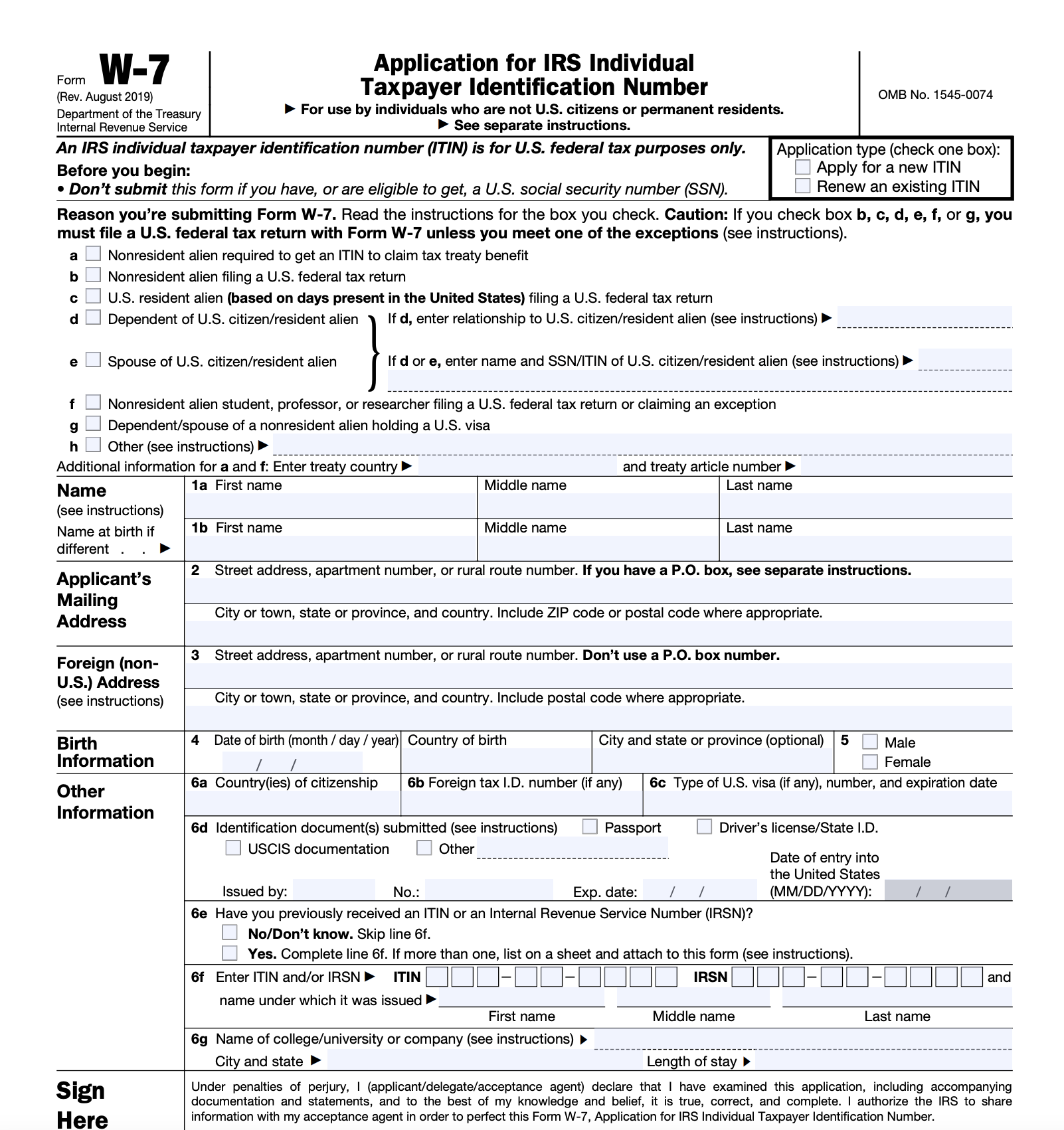

For non-immigrants your expiration date is dependent on your admit to date. For many wholesalers and. If your childs A Program is serviced by a private provider.

A Hawaii tax id number can be one of two state tax ID numbers. The fee is 5 per year or fraction thereof. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for.

Hawaii tax id number cost Tuesday February 22 2022 Edit. The amount of the refund is 100 or 300 per exemption person.

Understanding The Employer Identification Number Ein Lookup

Fresh Certificate Of Compliance Template Certificate Templates Certificate Of Completion Template Free Certificate Templates

Licensing Information Department Of Taxation

Tax Clearance Certificates Department Of Taxation

![]()

Federal Tax Id Number Ein Incorp Com

Tax Identification Number Application Form 2022 Portal Update Current School News

County Surcharge On General Excise And Use Tax Department Of Taxation

The Worst States For Taxes Travel Nursing Pay Tax Deductions Tax Services

Tax Id Numbers Why They Re Important And How To Get One Bench Accounting

Individual Taxpayer Identification Number Itin Guide For Immigrants

Understanding The Employer Identification Number Ein Lookup

Individual Taxpayer Identification Number Itin Guide For Immigrants

This Map Shows The Hourly Wage You Need To Afford A 2 Bedroom Apartment In Your State Low Income Housing Minimum Wage Map